Here are 10 of the Most Exclusive Credit Cards Available in 2020

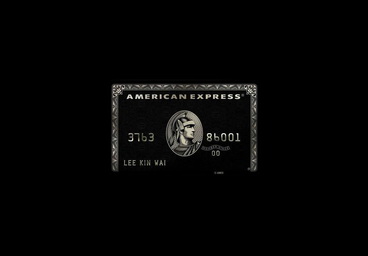

1. American Express Centurion® Credit Card (Black Card)

American Express Centurion® Credit Card

- Intro APR: None

- Regular APR: N/A (charge card)

- Annual Fee: $7,500 initiation fee, $2,500 annual fee

- Credit Needed: By invitation only

Our list of the most expensive credit cards starts with the famed American Express Black Card. The true name for this card is the Centurion Card. Part of its appeal is the mystery behind the card. This card isn’t open to the public, and American Express has to reach out to you first to qualify. It’s rumored that only those who spend (and pay off) at least $250,000 to $450,000 per year across all of their American Express accounts are invited to become Centurion Cardholders.

The Luxury Card: Mastercard® Gold Card

Mastercard® Gold Card

- Intro APR: 0% for 15 months on balance transfers

- Regular APR: 16.49% variable

- Annual Fee: $995

- Credit Needed: Excellent

Those looking for industry-leading rewards and perks without waiting around for an invitation should check out the Mastercard Gold Card. For the (relatively) low annual fee of $995, cardholders receive services through the Luxury Card Concierge; $200 in credits toward qualifying airline purchases; a members-only subscription to Luxury Magazine, and unspecified luxury gifts. The card itself is constructed, at least partially, of 24-carat gold.

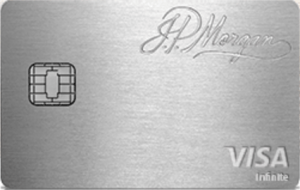

The JP Morgan Reserve Card (formerly the JP Morgan Chase Palladium Card)

JP Morgan Reserve Card

- Intro APR: N/A

- Regular APR: N/A

- Annual Fee: $595

- Credit Needed: By invitation only

Do you have $10 million or more to invest with JP Morgan? If so, the next card in our ultra-exclusive list — the JP Morgan Chase Reserve Card — may be right for you. This card, which replaced the JP Morgan Palladium Card, is targeted to extremely high net worth clients. Like its predecessor, the Reserve Card is made of metal with palladium plating, and it weighs approximately five times as much as a conventional plastic credit card. It is offered only to clients of JP Morgan’s Global Wealth Management who have investible (non-real estate) assets of $10 million or more, so this is truly a credit card for the rich.

The Citigroup Black Chairman Card

Citi Chairman® American Express® Card

- Intro APR: N/A

- Regular APR: 11.24% variable

- Annual Fee: $500

- Credit Needed: Excellent

The Citi Chairman American Express Card’s exclusivity is owed to the fact that membership in this card club is only open to those who have significant investments with a Citigroup brokerage account.

It’s rumored to come with a credit limit as high as $300,000 and a relatively low annual fee of $500.

Leave A Comment

You must be logged in to post a comment.